In this blog series we are exploring the latest fraud-related events and issues on the rise in our digitized world. The first installment in the series explored account takeovers (ATO) and the $7 billion yearly loss affecting even the largest organizations.

In this post, we are examining three current trends contributing to increased fraud in the retail and e-commerce verticals:

- Increased online transactions

- Data breaches from the early pandemic chaos

- Omnichannel fraud

This topic is especially timely as we are well into the holiday season. With the dramatic surge in online transactions driven by the pandemic, fraudsters are showing no hesitation targeting the unprecedented volume of new accounts and new methods for getting products and services to consumers. Deloitte is forecasting e-commerce sales to grow 25 – 35 percent with sales expected to reach $182 – $196 billion, compared to a 14.7 percent increase in 2019.

1. Record setting creation of new online accounts

In April, ACI Worldwide reported a 209 percent year-over-year growth in global ecommerce retail sales. A significant contributor to this rapid growth is new customer accounts which now represent 30 percent of transactions, a fivefold increase from pre-pandemic times, according to Help Net Security. Less experienced online users are at increased risk of fraud, as they are less likely to employ advanced security steps. With the responsibility of providing quick and seamless customer experiences, retailers must protect customer data while keeping up with the surge in new customer accounts.

The explosion of online shopping transactions is diluting the percentage of fraud attacks across all channels, giving the false perception they are on the decline. While the percentage is shrinking, the number of fraud attacks in real terms has risen. Large online merchants selling digital goods and physical goods have been hit hardest. They’ve seen an average monthly increase in fraudulent transactions of 37.1 percent and 14.3 percent, respectively, according to Digital Commerce 360.

Additionally, there’s been a 66 percent increase in fraudsters re-targeting websites that previously failed to identify their attacks. Often these repeat attacks are occurring in newer and more vulnerable areas of the customer journey including loyalty programs and return policies.

Also on the rise is the cost of fraud for United States-based merchants. Shooting up 7.3 percent from 2019, both store-based and online retailers are paying $3.36 for every $1 of fraud. For United States e-commerce merchants it’s $3.73 per $1 of fraud, according to Digital Commerce 360. What’s more, United States merchants in 2020 were projected to see roughly $33 billion in payment card fraud loses before the pandemic.

2. Perfect storm of record setting transactions for the holiday season

In a survey of 500 e-commerce companies, 96 percent agreed that this year’s holiday shopping season is more important to their business than in 2019.

However, it will also be a prime time for fraudsters to capitalize for a few reasons. Primarily it’s due to the same confluence of events that already made more fraud possible: high transaction volumes, minimal or legacy security measures, and merchants and users who are new to online retail. Second, is the speculation that fraudsters will operationalize data they’ve already stolen. Chaos and confusion early in the pandemic created opportunities for data breaches and social engineering scams. The holidays offer an opportunity to exploit that data with fraudulent purchases, money stolen, or rewards points and credits usurped, according to TechRepublic.

3. Omnichannel delivery is convenient for fraudsters too

With the overnight changes in the ways that retailers could sell and consumers could buy, omnichannel delivery options became a must. However, as merchants have been pushed to provide new channels to serve customers, it has exposed new vulnerabilities. Therefore, omnichannel fraud is also on the rise. Buy Online, Pick-Up In Store (BOPIS) fraud rose 55 percent, according to Help Net Security. This trend is expected to increase with the surge in online shopping over the holidays.

How Dynamics 365 Fraud Protection can help prevent fraud

While many of the challenges that retailers and e-commerce merchants are facing are a result of operating in a vastly different landscape, several are coming from their legacy fraud prevention systems. That fivefold increase in new users we mentioned earlier is taxing to a legacy systems’ ability to identify legitimate users. Companies trying to keep up with the overwhelming number of fraud signals often rely on systems that generate false positives, incorrectly rejecting legitimate and loyal buyers. During a time when a single transaction can seemingly make or break a business, merchants cannot afford to lose customers or sales.

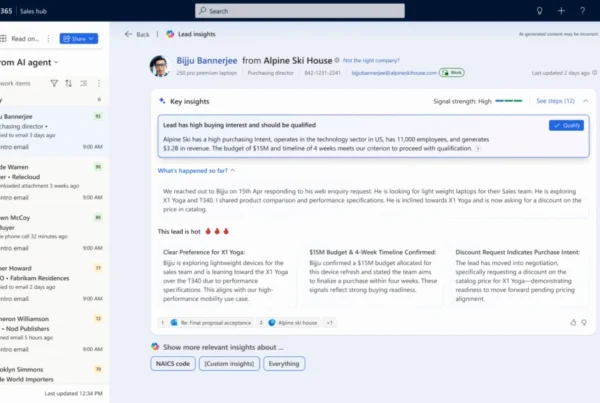

Microsoft Dynamics 365 Fraud Protection helps merchants combat against the types of fraud and legacy security systems gaps that are threatening to make the holiday shopping season less than merry.

A cloud-based solution recently awarded the Juniper cybersecurity platinum award, Dynamics 365 Fraud Protection is designed to help e-commerce, brick-and-mortar, and omnichannel merchants protect revenue and reputation. Deploying adaptive AI technology that continuously learns, Dynamics 365 Fraud Protection defends against purchase, account, and omnichannel return and discount fraud while reducing operational expenses and increasing acceptance rates. It also safeguards user accounts from fraud exposure helping to retain customers and maintain satisfaction.

Dynamics 365 Fraud Protection offers three capabilities which can be integrated together or used individually, providing merchants the option to use the capability that best suits their business needs:

1. Account protection helps protect online revenue and reputation and safeguard user accounts from abuse and fraud by combating fake account creation, account takeover and fraudulent account access.

In the first trend above, new customer accounts represent 30 percent of transactions. These online users with weaker security could utilize account protection capability to help safeguard accounts. Businesses and merchants with account protection could protect their customers’ data by preventing fraudulent account access. Rather than worry about keeping their customers data safe, merchants can focus back on seamless customer experiences. With both fraud attacks and cost of fraud to United States merchants rising, there is no better time to add the account protection capability to your toolkit.

2. Purchase protection helps protect revenue by improving the acceptance rate of e-commerce transactions with insights and tools that help balance revenue opportunity verses fraud loss and checkout friction.

The second trend highlights the need for purchase protection. With a higher number of transactions and new online users entering their card information, purchase protection can help keep good customers happy while helping mitigate fraud loss.

3. Loss prevention helps protect revenue by identifying anomalies on returns and discounts arising from omnichannel purchases, enabling store managers and loss prevention officers to quickly investigate potential fraud and take action to mitigate losses.

Our third trend, omnichannel delivery, is a growing area for fraudsters to strike. Loss prevention helps analyze merchant’s data and to identify patterns of anomalies to increase merchants’ visibility into potential fraud on returns and discounts while notifying store managers so action can be taken to prevent losses. It’s time to fight Buy Online, Pick-Up In Store (BOPIS) fraud with the loss prevention capability.

Learn more

Learn additional information about Dynamics 365 Fraud Protection capabilities including account protection, purchase protection, and loss prevention and check out the ebook, Protecting Customers, Revenue, and Reputation from Online Fraud.

Questions? Please contact your Microsoft sales representative to learn more about Dynamics 365 Fraud Protection capabilities.