In times of economic uncertainty, business agility is critical to meeting stakeholder expectations and delivering customer value. These challenging times put CFOs and finance teams in the spotlight as leaders across the business look to them to protect short-term financial health and long-term growth. Yet, many leaders struggle to get the insights needed to pivot quickly. Join us at Finance Reimagined on February 28, 2023 to see how automation, AI, and analytics can help you lead the way through disruption.

While business intelligence (BI) and cloud analytics tools can provide actionable insights, a significant obstacle that hinders finance professionals and business leaders from maximizing the potential of these tools is the need for advanced technical skills to consolidate, manipulate, and integrate data from various systems utilized in business operations. This requires a deep understanding of complex data models and the ability to normalize, transform, and combine data sets to provide a coherent, usable output for all business users.

Historically, finance teams have spent most of their time running accounting and financial operations, closing the books, and creating financial reports and statements. Business performance insights were delivered monthly, quarterly, or yearly. As the speed of business has accelerated and continues to accelerate at an unprecedented pace, finance professionals are being asked to deliver performance metrics daily and at a micro level. Many teams have invested in data scientists and reskilling their people to take on modern data storytelling roles. However, this approach does not scale. To achieve the level of business agility to succeed in ultra-competitive markets, business leaders need to activate actionable insights securely at every level of the organization. This means that all people, regardless of their technical expertise, need the ability to get the analytics they need to understand business performance better.

The question becomes, how do we get the business performance analytics needed in the hands of people across the organization? The answer lies in creating a hyper-connected enterprise through an intuitive data model and empowering people to use familiar tools like Microsoft Excel and Power BI for self-service analytics.

Finance leaders can create a hyper-connected enterprise

Although CFOs may not be directly responsible for data security and connectivity, a strong partnership between finance and IT is crucial for successfully implementing business performance analytics. During our upcoming virtual event, Finance Reimagined, on February 28, 2023, you will hear how Robert Walters, a leading global recruitment and talent management company, strengthened their partnership by adding a finance expert to their IT team. The results were remarkable, as they were able to replace their financial management solution on time and within budget, providing near real-time insights to all recruiters within their workflow. Easy access to correct information enables teams to achieve strategic objectives more efficiently and effectively.

With unified and accessible data, finance leaders can empower their teams to quickly gain insights and position themselves as leaders in innovation and business transformation. To realize these benefits, it is essential to consolidate all business data for a comprehensive view of the organization and embed intelligence in every function to promote proactive decision-making and collaboration among employees. To achieve this, finance leaders should collaborate with IT to:

- Unify data: Many well-defined business processes, like procure to pay, quote-to-cash, and other regular ledger and subledger processes, consist of a collection of documents related to the other. Unifying data from the ledger, subledger, and source documents makes using data from these different sources simpler.

- Simplify reporting: Streamlined reporting enables the finance team and other teams to create the reports they need, which previously would have taken weeks or months with IT experts or outside vendors.

- Adopt self-service analytics: Operationalizing custom reports and ad hoc analytics for the business through self-service analytics enables comprehensive digital transformation, even for organizations with limited IT investment. This empowers finance teams to use their data.

Actionable insights with self-service analytics

Self-service analytics refers to the ability of a business user to access unified, actionable data and intelligent technology to make informed decisions quickly. This technology is designed to be used by any user, no matter their sophistication, and can significantly contribute to driving growth and creating value beyond financial metrics. In the past, these benefits were challenging for organizations to achieve due to the complexity of technology implementation.

With self-service analytics, organizations can take advantage of technology that eliminates the need for finance professionals to have expertise in data science and IT, or access to external resources.

Now, Microsoft Dynamics 365 Finance users can validate data quality, generate customized reports, and easily extract valuable insights. With self-service analytics, finance teams can independently access, analyze, and use their data to make informed decisions.

Business performance analytics

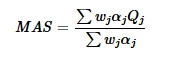

To tackle the challenges faced by CFOs and finance professionals in consolidating data and utilizing self-service analytics, we are proud to introduce new capabilities in Dynamics 365 Finance. Our latest innovation, business performance analytics, delivers insights directly to all users, regardless of technical ability. Business performance analytics empowers finance professionals to make informed decisions without needing advanced skills or data science understanding. This solution simplifies the process of gaining insights from data by providing a comprehensive and user-friendly view across multiple business processes.

With business performance analytics, all users can easily access and analyze data, helping to streamline regular financial reporting and shorten cycle times, allowing finance teams to focus on strategic initiatives. It enables reporting in a more holistic, less siloed way, across multiple systems of record, by normalizing data. Built on Microsoft Dataverse, it includes a web-based reporting hub where customers can create reporting via Excel, Power BI, and other templates.

Finally, with business performance analytics, we enhance the growth potential of Dynamics 365 Finance capabilities by leveraging unified data for AI and machine learning. With AI-powered solutions, we will enable teams to identify opportunities to improve financial performance automatically. Through our partnership with Open AI and recent acquisitions in business domains like process mining and AI-driven spend analytics, Microsoft will help auto-detect and recommend ways to protect organizations from risk and guard against future disruption.

Learn what’s next at Finance Reimagined

Integrating financial data across an entire organization and giving the finance team a wealth of self-serve analytics tools will deliver significant benefits across a business. Business performance analytics will be available in public preview with 2023 release wave 1. Our focus will be on ensuring the business performance analytics capabilities within Dynamics 365 Finance helps customers to:

- Simplify data insights by providing a comprehensive and user-friendly view across multiple sources in near real time.

- Allow all users of all technical abilities to quickly access and analyze data to facilitate faster decisions and better business performance.

- Enable ease-of-use through familiar apps like Excel and Power BI.

- Streamline financial reporting and operations to reduce cycle times and focus on strategic initiatives.

- Provide auditors with direct access to financial data, enabling them to quickly access and analyze the information they need, making the audit process more efficient.

Finance Reimagined

Learn how Dynamics 365 Finance can deliver the benefits of digital transformation, activating insights through analytics, AI, and automation.