For over a decade, revenue recognition has remained one of the most complex areas that finance leaders must navigate and manage. At the same time, more and more businesses are introducing subscription-based offerings in an effort to meet evolving consumer needs for innovative and convenient products and services while also creating new and predictable revenue streams. Indeed, the average US consumer now has four subscriptions, according to McKinsey & Company.1 It is no surprise then that the subscription economy is forecast to grow at a blistering pace in both B2C and B2B markets, rising 18.5 percent year-over-year from $224 billion in 2021 to $275 billion in 2022.2

As organizations add new subscription-based offerings, though, their revenue recognition processes become more complex, and many are challenged to incorporate the pricing and billing scenarios necessary to operate successfully at scale. To meet the growing need of organizations to manage the unique demands of subscription-based business models, we are excited to announce the general availability of Subscription billing for Microsoft Dynamics 365 Finance. Subscription billing is offered at no additional cost to users of Dynamics 365 Finance.

Introducing a new approach to Subscription billing

Often, the most difficult challenge of transitioning to new subscription-based business models is adopting the right technology solution and aligning operational processes to support the complexities of recurring revenue. For example, consumers pay for a single, convenient line item with product-as-a-service offerings. Internally though, obligations and financial performance must be managed. This usually requires organizations to become proficient at allocating portions of customer payments for revenue recognition in multiple revenue streams, such as separate accounting for hardware revenue and the monthly recurring revenue from related and ongoing service contracts.

Subscription billing is specifically designed for managing the ins and outs of recurring revenue and does so through three primary features: recurring contract billing, revenue allocation, and revenue and expense deferrals. In the remainder of this blog post, we provide a general overview of these features and explore how they help chief financial officers (CFOs) to tackle the challenges of the subscription economy.

Learn more: Subscription billing overview.

Recurring contract billing

The ability to correctly account for the revenue from complex subscription offerings is critical to obtaining an accurate picture of recurring revenue, maintaining financial compliance, and providing business leaders with the insights needed to accelerate growth. Subscription billing includes a recurring contract billing feature to help organizations overcome this specific challenge. With recurring contract billing, users have advanced control over pricing and billing parameters, contract renewal, and consolidated invoicing. Recurring contract billing can also handle specific billing requirements such as one-off, milestone, and usage-based, and can incorporate tiered or flat pricing strategies. Ultimately, the recurring contract billing feature shortens the quote-to-cash process. The user experience is also improved by providing an easy pathway to consolidate invoices by customer or item and simplifying the contact renewal and termination process.

Revenue allocation

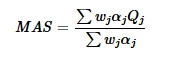

As we mentioned earlier, allocating revenue into several revenue streams for accounting purposes is one of the unique challenges that participants in the subscription economy face. The revenue allocation feature of Subscription billing provides users with the ability to automate complex allocations and to ensure revenue compliance by handling pricing and revenue allocation across multiple items. Specifically, it helps organizations comply with International Financial Reporting Standard (IFRS) 15 and Accounting Standards Codification (ASC) 606 by assigning default and standalone selling prices and methods to items. This way, users gain flexibility and control by allocating revenue based on standalone prices.

Revenue and expense deferrals

Another challenge in the subscription economy is remaining in compliance with regulations that are still evolving, especially around revenue and expense deferrals. With changing regulations on how organizations recognize revenue, finance teams are apt to get bogged down in spreadsheets, working manually to create formulas and consolidate data for reporting. However, with Subscription billing’s revenue and expense deferrals feature, users can automate revenue and expense deferral processes in alignment with US generally accepted accounting principles (GAAP) standards. The solution also provides a robust and straightforward way of creating schedules for future period postings and consolidating invoices.

What’s next?

In this article, we discussed the growth of the subscription economy and the unique challenges that organizations face when transitioning or adding new subscription-based business models. We looked at how three features, recurring contract billing, revenue allocation, and revenue and expense deferrals, help CFOs tackle the challenges of the subscription economy.

Subscription billing is offered at no additional charge to users of Dynamics 365 Finance––and we’re excited to announce some recent enhancements that make this offering even better. Thanks to a new licensing agreement with Binary Stream Software, Subscription billing now includes advanced features such as support for complex billing, both usage-based and tiered models, and advanced reporting capabilities for companies with recurring revenue. To learn more, check out our recent webinar, How to thrive in a subscription economy, where you can hear from our guest speaker, CEO and President of Binary Stream Software, Lak Chahal.

Sources:

1- McKinsey & Company, 2021. Sign up now: Creating consumer—and business—value with subscriptions.

2- Juniper Research, 2022. What Will the Subscription Economy Deliver in 2022?