This year has been unexpected to say the least. As 2019 ended and business forecasts were written, no one would have ever guessed what was to come in 2020.

As consumer behaviors have shifted in uncertain times, merchants worldwide have quickly adapted and implemented new technologies, tools, and strategies to maintain business continuity and increase their online presence. Unfortunately, as online activity and e-commerce continues to rise, so does potential for exposure to fraud.

In this blog series, we will highlight some of the latest fraud-related events and issues on the rise in our digitized world, affecting individuals and businesses alike. Our goal is to better educate customers on what type of fraud can occur and how they happen, while sharing how solutions like Microsoft Dynamics 365 Fraud Protection can help protect businesses from a similar attack. With the fraud landscape changing every day, Dynamics 365 Fraud Protection strives to help businesses stay ahead of the game.

In this first installment, we will discuss the impact of account takeover (ATO) fraud, a type of identity fraud that can incur massive monetary losses for individuals and, for businesses, lost revenue and damaged reputations.

The impact of account takeover

In a world overflowing with technology and data, there is a constant challenge to protect that data from fraudsters. As software continues to evolve to protect information, so do fraudsters, requiring continuous improvement to security to prevent and identify breaches. For most people, this multi-billion dollar battle goes unnoticed unless they are directly impacted or a story of fraud hits the front page news.

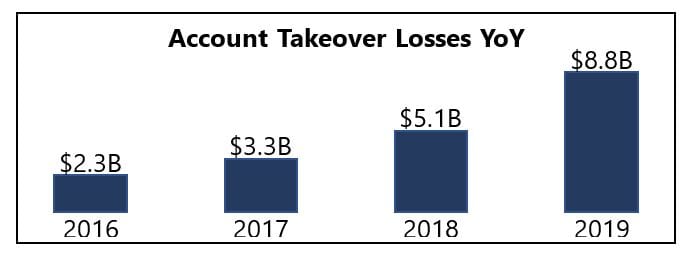

So, what is account takeover? ATO is when a fraudster gains access to an account they don’t own, changes account information, and makes unauthorized transactions. It’s a type of fraud that can affect businesses small and large. ATO incurs tens of billions of dollars in fraud losses every year.

Fraud due to ATO is on the rise, growing faster every year as the world becomes more digitized. In 2017, ATO accounted for $5.1 billion in losses, and according to Juniper Research, online fraudulent transactions are expected to reach $25.6 billion in 2020.

ATO also occurs in the form of fraudsters taking over an account and making fraudulent purchases, or even open new accounts using the victim’s information. This crisis affects both the individual entity who has had their information stolen and the businesses the fraudsters interact with, resulting in United States businesses losing a reported $7 billion in 2019. Another issue with ATO is fraudsters are also taking over mobile phone accounts at an arming rate with 680,000 people falling victim in 2019, a rise of 78 percent from the previous year. ATO is a problem that needs to be addressed to help protect individuals and businesses alike, and luckily, solutions are available to prevent the devastating impacts.

How Dynamics 365 Fraud Protection can help prevent fraud

This is where Microsoft comes in, providing a solution to help protect businesses from fraudulent activity with the implementation of Dynamics 365 Fraud Protection. Recently awarded the Juniper cybersecurity platinum award, this suite of services enables users to gain access to Purchase Protection and two new capabilities, introduced in July 2020: Account Protection and Loss Prevention. The 2020 release wave 2 updates include better integration with Microsoft Dynamics 365 Commerce, among other updates for Dynamics 365 Fraud Protection.

- Account protection is where the solution to protect accounts from ATO comes into play. Account Protection from Dynamics 365 Fraud Protection safeguards against ATO with the use of adaptive AI technology, BOT protection, device finger printing, the fraud protection network, and account creation and sign-in protection. With these tools, businesses and their users can be better protected from fraudsters attempting an ATO, ultimately protecting sensitive information and the business’s bottom line.

While fraud continues to be on the rise each year, tools to help shield businesses from fraudsters are becoming more readily available. As solutions like Dynamics 365 Fraud Protection utilize the power of AI to continually improve the effectiveness and efficiency of their programs, they can help to better defend businesses against fraud and protect their revenue.

- Loss prevention helps protect your revenue by identifying potential fraud on returns and discounts arising from omnichannel purchases, enabling store managers and loss prevention officers to quickly take action to mitigate losses. Adaptive AI technology continuously learns and adapts from fraud patterns, working together with the fraud protection network to equip merchants with the tools they needed to optimize fraud controls related to discounts and returns.

- Purchase protection helps merchants protect online revenue by improving commerce transaction acceptance rates while reducing checkout friction and providing merchants with insightful tools to make decisions that appropriately balance revenue opportunity and customer experience verses fraud loss. The transaction acceptance booster enables merchants to share transactional trust knowledge with issuing banks to help boost authorization rates and reduce wrongful rejects, helping protect revenue streams. Read how Microsoft is teaming up with Capital One and American Express to battle fraudulent purchases. In the 2020 release wave 2, capability will be added to the transaction acceptance booster for merchants to enable sharing of additional contextual data. More coverage will also be added for merchants with additional partner banks.

Next steps

Learn more about our comprehensive fraud protection with Dynamics 365 Fraud Protection and stay tuned for the next blog post of our Fraud Trends Blog Series.

Questions? Please contact your Microsoft sales representative to learn more about Dynamics 365 Fraud Protection capabilities.